Private Irrevocable Non-Grantor Trusts: Legal Definition, IRS Treatment, and Strategic Advantages Over Statutory Trusts

Aug 11, 2025

Introduction

A private trust—particularly a private irrevocable non-grantor trust—is a legal arrangement in which a grantor transfers property to a trustee, who holds and manages it for the benefit of designated beneficiaries under terms established in a trust instrument. Unlike statutory trusts (created and regulated under specific state trust statutes such as the Delaware Statutory Trust Act), a private trust derives its validity and enforceability from the common law of trusts and the general contract law principles that pre-date most statutory frameworks.

From a tax standpoint, the Internal Revenue Service (IRS) treats a non-grantor private trust as a separate tax entity, subject to its own filing and income tax obligations under IRC Subchapter J (§641–§685). These trusts reach the highest federal income tax bracket—37%—at just $15,200 of taxable income in 2024 (IRC §1(j)(2)(E)). This unique tax profile, combined with the flexibility and confidentiality of private trust law, makes them an attractive alternative to statutory trusts for certain individuals and families.

1. Legal Standpoint: What is a Private Trust?

Legally, a private trust is governed primarily by:

-

Common law trust principles (Restatement (Third) of Trusts).

-

The trust instrument (the written declaration or agreement).

-

Applicable state trust law, except where preempted by federal law.

Core Elements (per Restatement (Third) of Trusts §2):

-

A trustee who holds title to trust property.

-

Identifiable beneficiaries.

-

Trust property (res).

-

Intent to create a trust.

-

Lawful purpose.

Case Law Guidance:

-

Markosian v. Commissioner, 73 T.C. 1235 (1980) – Established that a trust must have economic substance beyond tax benefits; sham trusts are disregarded.

-

Helvering v. Clifford, 309 U.S. 331 (1940) – Addressed grantor control and reversionary interests in determining whether a trust is separate for tax purposes.

-

Commissioner v. Estate of Bosch, 387 U.S. 456 (1967) – Federal tax authorities are not bound by lower state court determinations of trust validity if inconsistent with state law.

Private trusts are non-statutory in that they are not created under special enabling statutes like a Delaware Statutory Trust (12 Del. C. §3801 et seq.), but rather under the broader trust law that exists in all states.

2. IRS Definition and Tax Standpoint

The IRS does not use the term “private trust” in the Internal Revenue Code. Instead, it classifies trusts generally as simple trusts, complex trusts, or grantor trusts based on §§651–§678.

A private irrevocable non-grantor trust for tax purposes:

-

Is separate from the grantor (IRC §641).

-

Files its own Form 1041 (U.S. Income Tax Return for Estates and Trusts).

-

Pays tax on retained income at trust tax rates (IRC §1(e)).

-

May take deductions for certain trust-level expenses, including depreciation (IRC §642(e); Treas. Reg. §1.642(e)-1).

IRS Guidance & Precedent:

-

Rev. Rul. 66-140 – Confirms depreciation deductions are valid at the trust level for income-producing assets.

-

PLR 201110020 – Confirms bonus depreciation (§168(k)) is available to properly structured irrevocable trusts.

-

CCA 199903001 – Clarifies allocation of depreciation within fiduciary returns.

3. Pros of a Private Trust Over a Statutory Trust

| Feature | Private Trust (Non-Statutory) | Statutory Trust |

|---|---|---|

| Creation | Common law + trust instrument; no state filing requirement. | Created under specific state statute; requires state filing. |

| Privacy | High – trust documents generally remain private. | Lower – some filings may be public record. |

| Flexibility | Terms defined almost entirely by the trust instrument. | Bound by statutory framework and definitions. |

| Jurisdictional Choice | Can be sited in any state with favorable trust law. | Bound by the enacting state’s statutory terms. |

| Tax Treatment | Flexible; may elect grantor or non-grantor status; can optimize deductions, income retention, and reinvestment strategies. | Generally treated as business entities for tax purposes unless electing trust treatment. |

| Asset Protection | Strong, especially in states with favorable spendthrift provisions. | Varies by statute; some provide strong protection, others less so. |

Why Choose a Private Trust?

-

Confidentiality: No public registration keeps family wealth planning private.

-

Control: The trust instrument—not statutory defaults—governs terms.

-

Flexibility in Administration: Can be tailored to unique family or business needs without statutory limits.

-

Jurisdiction Shopping: Can choose governing law for favorable tax, asset protection, or perpetuity periods.

-

Tax Planning Opportunities: Ability to retain income, strategically reinvest, and utilize depreciation over time to recover tax burden lawfully.

4. Addressing Common Confusion About “Types” of Private Trusts

A frequent source of misunderstanding arises when people ask whether a private trust is the same as a real estate trust, investment trust, or spendthrift trust.

The answer:

A private trust can be any or all of these — those terms are simply adjectives describing the powers the trust holds or the provisions enumerated within the trust instrument. They are not mutually exclusive categories.

-

Real Estate Trust – A trust whose assets include real property. A private trust can hold title to real estate directly, or through an LLC or other entity.

-

Investment Trust – A trust that holds marketable securities, private equity, or other investments as its main assets.

-

Spendthrift Trust – A trust with provisions restricting a beneficiary’s ability to transfer or assign their interest, providing asset protection from creditors.

In a private trust, these characteristics are determined entirely by the trust instrument. If the settlor wants the trust to own real estate, invest in securities, and provide spendthrift protection, those powers and clauses can be written directly into the trust document.

5. How Public Statutory Trusts Are “Tested” and Regulated

In contrast, public statutory trusts—for example, a Delaware Statutory Trust or a Real Estate Investment Trust (REIT)—are creatures of specific statutes and are regulated both by state law and, in some cases, federal securities law.

Regulation happens through:

-

State statutory compliance:

-

Must meet the formal requirements of the enabling statute (e.g., 12 Del. C. §3801 et seq. for Delaware Statutory Trusts).

-

Filing of formation documents with a state agency (often the Secretary of State).

-

Ongoing compliance with statutory governance provisions (annual reports, registered agent, record-keeping).

-

-

Federal law compliance (if applicable):

-

REITs must meet the IRS qualification rules in IRC §§856–860 to maintain REIT tax status.

-

Certain public statutory trusts may be classified as investment companies under the Investment Company Act of 1940, triggering SEC oversight.

-

-

Testing for statutory criteria:

-

Public statutory trusts are often “tested” against statutory definitions to ensure they qualify for special treatment (e.g., REIT income and asset tests, Investment Company Act exclusions).

-

Failure to meet these tests can result in loss of status, penalties, or dissolution.

-

Key distinction:

Private trusts do not have to pass a statutory test to exist—they are valid so long as they meet the common law elements of a trust and do not violate public policy. Their powers, whether over real estate, investments, or asset protection, come from the trust instrument itself rather than from satisfying a statutory qualification.

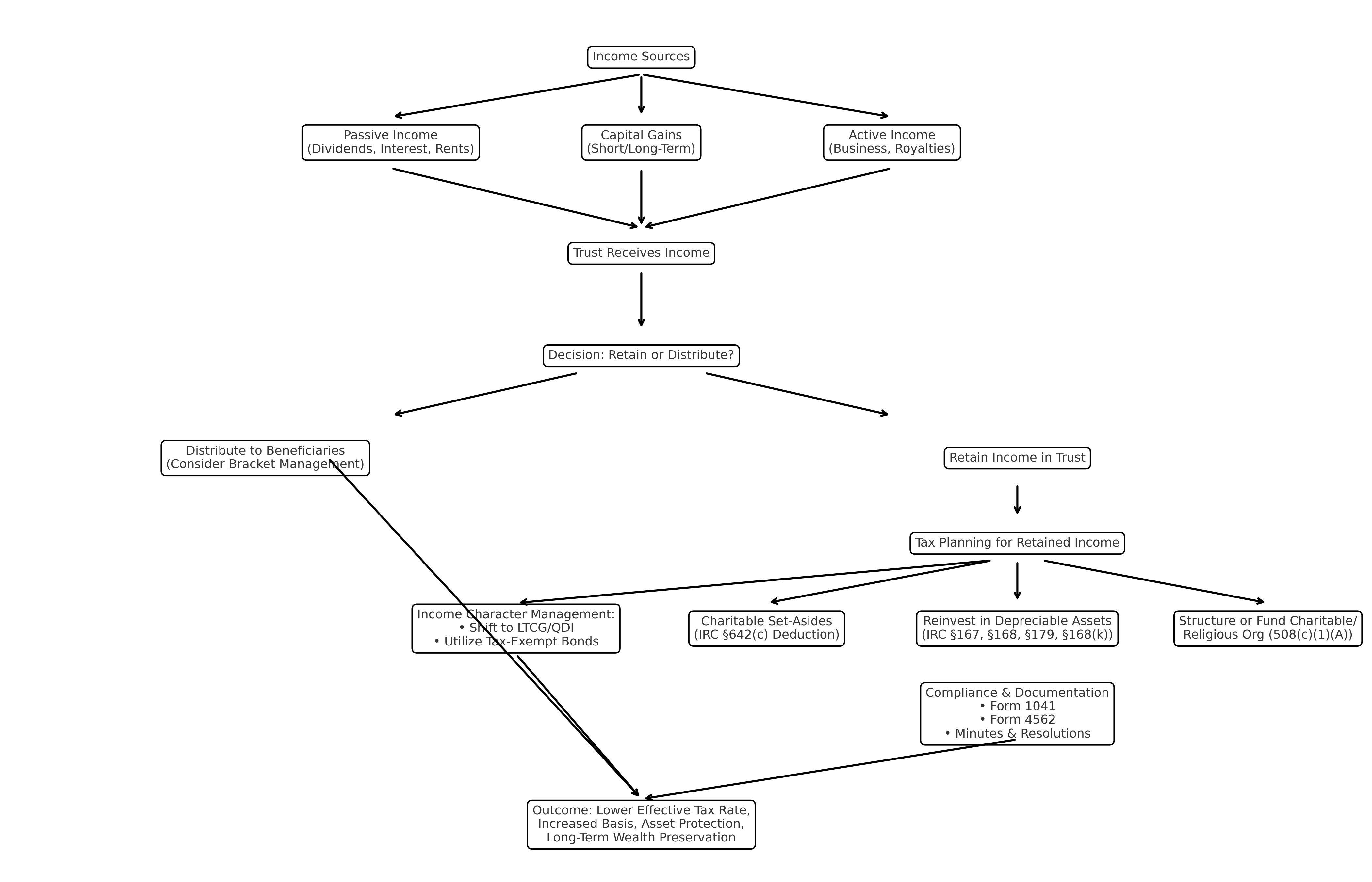

6. Practical Tax Implications — and Why the Wealthy Still Use Trusts Despite High Retained Income Rates

It’s true that non-grantor trusts face the top federal income tax bracket—37%—at just $15,200 of taxable income (2024 figures). On the surface, that may seem prohibitive. So why do high-net-worth individuals still use them?

The answer:

Because the tax code itself contains numerous lawful strategies that allow trusts to lower, defer, or offset taxable income while protecting and preserving wealth. The high nominal tax rate is only part of the picture—the structuring, asset mix, and proactive planning are what determine the effective tax paid.

Simply creating a private trust does not automatically produce tax savings. It is the ongoing administration and planning—analyzing what assets go into the trust, the types of income those assets produce, and how that income is allocated, distributed, reinvested, or set aside—that makes all the difference.

Examples of strategic tax planning within private trusts include:

-

Charitable Set-Asides – Under IRC §642(c), a trust may take an immediate deduction for income permanently set aside for qualified charitable purposes, even if the distribution is made in a later year.

-

Reinvestment into Depreciable Assets – Purchasing income-producing property or equipment allows the trust to take depreciation deductions (IRC §167, §168) year after year, adding to the trust’s basis and recovering part of the initial tax paid over time.

-

Structuring Charitable or Religious Organizations – Aligning the trust with a 501(c)(3) or 508(c)(1)(A) entity can create pathways for income to support the organization’s purposes while reducing taxable income at the trust level.

-

Income Character Analysis – Different types of income (qualified dividends, tax-exempt interest, capital gains, ordinary income) are taxed differently. Planning which assets the trust holds and how they produce income can dramatically influence effective rates.

-

Distributions to Beneficiaries in Lower Tax Brackets – While retaining income may be strategic in some years, in others, passing income through to beneficiaries with lower rates can reduce overall family tax liability.

For the wealthy, the trust is not merely a container for assets—it is an active financial engine. Its power lies in the legal and tax tools embedded in the trust agreement and in annual, proactive adjustments that ensure assets, income streams, and expenses are working together to achieve the trust’s long-term goals.

When used with informed fiduciary management, charitable intent, and strategic reinvestment, a private trust becomes more than a tax-paying entity—it becomes a tax-managed, wealth-preserving structure.

7. Legal & Tax Compliance Requirements

-

Must have economic substance (Markosian, supra).

-

Must file timely Form 1041 and Form 4562 for depreciation.

-

Must maintain separate books, records, and bank accounts (avoid commingling).

-

Must follow the trust instrument’s terms and avoid prohibited self-dealing (IRC §4941 for charitable trusts).

Conclusion

From both a legal and tax standpoint, a private irrevocable non-grantor trust is a powerful vehicle for asset protection, privacy, and long-term tax planning. While the IRS imposes steep tax rates on retained trust income, careful structuring and lawful reinvestment strategies—especially into depreciable income-producing assets—can substantially mitigate that burden over time.

The decision to choose a private trust over a statutory trust often comes down to control, confidentiality, and flexibility—qualities inherent in the common law foundation of private trusts, reinforced by prudent fiduciary administration and informed tax strategy.

Sources:

-

IRC §1(j)(2)(E) – Federal income tax rate schedules for trusts and estates (2024 rates)

-

IRC §212 – Deduction for ordinary and necessary expenses for income production

-

IRC §641–§685 – Subchapter J – Taxation of estates, trusts, beneficiaries

-

Treas. Reg. §1.167(a)-10(b) – Depreciation deductions by fiduciaries

-

Treas. Reg. §1.642(e)-1 – Allocation of trust-level expenses

-

IRS Form 1041 – U.S. Income Tax Return for Estates and Trusts

-

Rev. Rul. 66-140 – Depreciation deductions for income-producing trust property

-

CCA 199903001 – Allocation of depreciation within fiduciary returns

-

Markosian v. Commissioner, 73 T.C. 1235 (1980) – Economic substance requirement for trusts

-

Helvering v. Clifford, 309 U.S. 331 (1940) – Grantor trust control and reversionary interest

-

Investment Company Act of 1940 – SEC regulation of certain investment trusts